Financial Resources Formulary: Unterschied zwischen den Versionen

Keine Bearbeitungszusammenfassung |

|||

| (4 dazwischenliegende Versionen desselben Benutzers werden nicht angezeigt) | |||

| Zeile 82: | Zeile 82: | ||

* '''Stock price P<sub>0</sub> in the single-period case:''' [[Datei:Form_P0_einperiodig.png]] | * '''Stock price P<sub>0</sub> in the single-period case:''' [[Datei:Form_P0_einperiodig.png]] | ||

* '''Dividend discount model''' for the stock price P0 in the multi-period case until time horizon H: [[Datei: | * '''Dividend discount model''' for the stock price P0 in the multi-period case until time horizon H: [[Datei:cw_DDM_v2.png]] | ||

* '''Stock price P<sub>0</sub>''' with specific dividends until time horizon H and growing dividends after H: [[Datei:Form_P0_growth.png]] | * '''Stock price P<sub>0</sub>''' with specific dividends until time horizon H and growing dividends after H: [[Datei:Form_P0_growth.png]] | ||

| Zeile 165: | Zeile 165: | ||

== Exercises == | == Exercises == | ||

[[Financial Exercises | Please try our [[Financial Exercises]] or have a look at the [[Financial Ratios]] or at our [[Investition|investment pages]].<br/> | ||

[[Financial | |||

Aktuelle Version vom 14. Mai 2012, 10:08 Uhr

by Clemens Werkmeister

Present values, perpetuities and annuities

Present value PV: value of a future payment Ct (in year t), discounted to year 0: ![]()

Future value FVt: value of a present payment (in year 0), calculated by compounding to year t: ![]()

- t year

- r discount rate (interest rate)

discount factor with discount rate (interest rate) r for t years

discount factor with discount rate (interest rate) r for t years- Ct cash flow in year t

- C0 initial investment of a project (for normal investment projects: C0 < 0)

- T number of years of the project

The sum of several present values is a PV, too (additivity of present values):![]()

Net present value NPV: PV of future payments (of a project or a company) plus the - usually negative - initial investment C0: ![]()

Perpetuity (console): a periodic (annual) payment C that is received or paid forever (beginning with the first payment at the end of year 1):![]()

Annuity: a payment of a level cash flow C during a specified number of years (from year 1 to n). Its present value can be calculated as difference between two perpetuities: ![]()

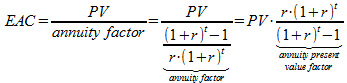

Annuity (recovery) factor: average payment at the end of n periods, corresponding to a present value PV and considering for interest rate r:![]()

Annuity present value factor: factor for the PV of n equal payments at the end of years 1 to n: ![]()

The annuity C for years 1 to n corresponding to a present value PV and discount rate r is: ![]()

Growing perpetuity: a perpetuity starting with cash flow C1 in year 1 and increasing by the annual growth rate g forever:![]() (for t = 1, 2, …, ∞ ;g < r) and

(for t = 1, 2, …, ∞ ;g < r) and ![]()

Growing annuity: an annuity starting with cash flow C1 in year 1 and increasing by the annual growth rate g for n years: ![]() (with t = 1, 2, …, n)

(with t = 1, 2, …, n)

Internal rate of return (IRR): discount rate that results in NPV = 0: ![]()

Profitability index: ratio of NPV to investment of a project: ![]()

Equivalent annual cash flow (EAC): cash flow per year with the same present value as the actual cash flow of the project:

Interest and discount rates

Effective annual rate (EAR): annualized rate of shorter period interest rates (monthly, daily rates) using compound interest:

- - EAR for a monthly rate m: EAR = (1+m)12 – 1

- - EAR for a daily rate d: EAR = (1+d)360 – 1 (for 360 days per year)

Given an annual percentage rate (APR) of r, the corresponding EAR with respect to n shorter periods of equal length is: ![]()

Effective annual rate with continuous compounding: effective annual rate for n → ∞ shorter periods: ![]() (being r the simple annual rate)

(being r the simple annual rate)

Annual percentage rate (APR) or simple rate: annualized rate of shorter period interest rates (monthly, daily rates) using simple interest.

- - APR for a monthly rate m: APR = 12 * m

Real rate of return: rate of return adjusted for inflation: ![]() →

→ ![]() (being i the inflation rate)

(being i the inflation rate)

Valuing bonds

- Ct annual coupon interest payment

- F face value (or principal)

- r discount rate (yield to maturity)

- N maturity

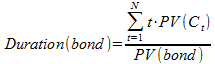

Duration of a bond with maturity N: weighted average period of bond payments:

Modified duration: a measure of volatility (elasticity) of bond prices: ![]()

Valuing stocks

(Expected) Stock return r (equity cost of capital): ![]()

Present value of growth opportunities (PVGO): net present value of a firm's future investments.

Return (Equity cost of capital) of a perpetual stream of dividends with growth: ![]()

Return on Equity with market values: ![]()

Payout ratio: fraction of earnings paid out as dividends: ![]()

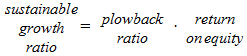

Plowback ratio: fraction of earnings retained by the firm: ![]()

Sustainable growth rate: rate at which a firm can steadily grow:

Discounted cash flow (DCF): value of the free cash flows that are available to investors plus company value at the planning horizon, all discounted to present: ![]()

Risk and return

Risk premium of an asset: asset return – return of risk-free asset.

Variance: expected value of squared deviations of observations from their expected value (mean): ![]() (based on j observations)

(based on j observations)

Standard deviation: a measure of volatility of expected stock returns: ![]()

Expected portfolio return (with two assets): ![]()

Expected portfolio return (with j = 1, …, n assets): ![]()

- xj weight of asset j in the portfolio

- rj (expected) return of asset j

Variance of portfolio return (portfolio variance) in the case of two assets: ![]()

Covariance between asset i and j with ![]()

Correlation coefficient between asset i and j: ![]()

Variance of portfolio return (portfolio variance) in the case of n assets: ![]()

Sharpe-Ratio: ratio of risk premium to risk (standard deviation): ![]()

Beta of the return of asset j to the market return (return of market portfolio m): ![]()

Expected return following the security market line equation (SML): ![]()

Expected return of a stock in event studies: ![]()

Abnormal return = actual return – expected return = ![]()

Capital Structure and Return

Weighted average cost of capital (WACC): ![]()

- rD interest rate on debt resp. debt cost of capital

- rE return on equity resp. equity cost of capital

- Tc corporate tax rate

Weighted average cost of capital (WACC) with a zero-tax rate: ![]()

Leverage-formula for return on equity: return on equity increases with debt/equity-ratio: ![]()

Leverage-formula for equity beta: risk increases with debt/equity-ratio: ![]()

Exercises

Please try our Financial Exercises or have a look at the Financial Ratios or at our investment pages.